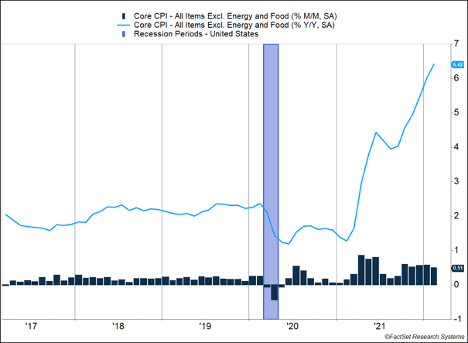

Inflation continued to bound higher last month. The Consumer Price Index (CPI) climbed 0.8% last month and is 7.9% higher than one year ago. The big culprits were food and energy. Food prices leapt 1% last month and gasoline prices increased 6.6% as part of an increase in overall energy prices of 3.5%. Core CPI increased 0.5% as the big increases in food and energy are omitted from core inflation. Car prices, which have contributed to inflationary pressures, were flat last month. Increased rent costs, which are applied to homeowners as well, were a top contributor to inflation.

Key Points for the Week

- Consumer inflation jumped another 0.8% as energy and food prices climbed further.

- The Federal Reserve meets this week and is widely expected to raise interest rates by 0.25%.

- The U.S. banned Russian oil and gas imports as the world continues to ratchet up the pressure against Russia.

The Federal Reserve has already signaled it plans to raise rates 0.25% at its meeting this week. The widely expected increase will follow the end of the Fed’s program to purchase Treasury debt and government-backed mortgages. As the results of the meeting are widely expected, much attention will be focused on the Summary of Economic Projections, which indicates how Fed officials expect interest rates to move in the future.

The world is steadily placing more economic pressure on Russia by increasing sanctions. The U.S. has elected to wean itself off Russian oil, while an expanding group of corporations is exiting the Russian market.

The S&P 500 slid 2.8% last week and is 11.5% lower this year. The MSCI ACWI dropped 2.3% on concerns the situation in Ukraine combined with U.S. inflation may produce an adverse market outcome. The MSCI Europe index bounced off recent lows and added 2.7% last week. The Bloomberg U.S. Aggregate Bond Index fell 1.8% as the strong inflation numbers pressured bond prices. In addition to the Fed meeting, U.S. retail sales lead a list of key economic releases this week.

Figure 1

When Will We Get There?

If you travel with young children, you have experienced the joys of answering the same question over and over: “When will we get there?” Today’s investing environment will likely leave many asking the same question regarding the impact of the Federal Reserve’s plans to raise interest rates and the economic sanctions against Russia.

The journey to higher rates is expected to begin this week and to last the rest of the year. Investor expectations indicate the Fed will raise rates 0.25% at each of the next three meetings and may continue raising rates at that pace for the rest of the year. Many currently expect the Fed to raise rates 0.50% sometime this year to control inflation more rapidly. The inflation data released last week indicated the Fed has a lot of work to do. CPI jumped 0.8% last month, and core CPI, which excludes food and energy, climbed 0.5%. Both are well above target and indicate the Fed will be focused on inflation throughout this year.

The challenge with monetary policy is it often takes a year or more before it is fully felt by the economy. The impact on the economy is slowed because many of the economic effects on ongoing projects is limited. If a large building project is already started, it will continue construction and continue to strengthen the economy.

Some factors could speed up the journey. The increase expected this week has been signaled for a while and rates may have already adjusted to future rate hikes. Higher rates pressure some investments whose payouts are further into the future. The recent decline in growth stocks is an example of rate expectations pressuring prices. Declining stock prices can cause people to lose wealth and choose to spend less, lowering the pressure on inflation.

The Fed also just wrapped up its bond-buying program designed to keep long-term rates low. The combination of rate hikes and the likely steady reduction of the Fed’s balance sheet could move long-term rates higher and speed the impact on the economy.

A follow up question to “Are we there yet?” might be “Why can’t we go faster?” A kid’s understanding of speed limits is quite limited, but the question is fairer for the Fed. One reason to go slow is some businesses and market participants may have extended their borrowing in a way that makes them vulnerable to a sharp change in rates. A 1% increase may cause permanent damage that four smaller hikes would avoid.

A second reason is the inflationary environment may change. The decline in COVID cases may spur a move away from inflation-inducing goods spending just as people are willing to return to work. Supply chain challenges may decline, and no one is certain how impactful these potential changes may be on inflation. Raising rates rapidly during a period in which the scarcity of energy supplies in some areas may slow demand as well. Small steady increases in rates with a focus on the trend and the absolute level seem to be the most prudent course.

The same question about interest rate policy can be applied to sanctions. Assuming the military situation remains unchanged, sanctions are a key offensive tool against Russia. Ukraine continues to make a spirited defense, but its military seems likely to be able to slow, not stop the Russian advance.

Sanctions are similar to rate increases in they are likely to pressure the economy with a lag. While the changes in interest rates and the currency are immediate, existing supplies in Russia will forestall deep economic pain. People can also do without for a while before the absence of some goods becomes a challenge. Eventually they start to make life worse and sap the economic and military strength of the target.

Sanctions are unlike interest rates because they are designed to prompt a policy change by key leaders. That decision could be to withdraw from or enter negotiations. It could be to prompt a coup or force a governmental restructuring where some power is passed to a new group. Those decisions are much different from the thousands of small decisions affected by higher rates.

Be patient with each type of policy and realize neither one has reached its destination. Rate hikes will slowly pressure inflation with near certainty, but how long it will take to see results is unclear. For sanctions, it is much more complicated. Like rate increases, they have some effect on a lot of people. As part of their larger goals, they may fail or they may appear to be failing right up to the moment when they work. We’ll be monitoring both policies closely as we monitor the investing environment.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

MSCI Europe Index

The MSCI Europe Index captures large and mid cap representation across 15 Developed Markets (DM) countries in Europe*. With 429 constituents, the index covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe.

https://www.federalreserve.gov/newsevents/speech/powell20210827a.htm

https://ddd.bis.org/publ/confp04l.pdf

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.newsnationnow.com/business/your-money/fed-interest-rates/

Compliance Case # 01303327