The U.S. economy seems to be returning to firmer footing based on economic data released last week. Initial jobless claims fell to 576,000 and are the lowest they have been since mid-March 2020. The number of people receiving some form of government jobless support dropped from 18.2 million to 16.9 million, based on data from three weeks ago.

Key Points for the Week

- The recovery continues, with employment showing improvement. Initial jobless claims fell below 600,000 for the first time since mid-March 2020.

- The Consumer Price Index surged 0.6% last month primarily due to increasing gasoline prices. Core inflation rose 0.3%.

- Retail sales surged 9.8%, fueled by government stimulus.

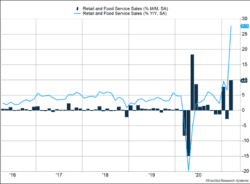

The U.S. consumer helped to drive up employment. U.S. retail and food service sales rose 9.8% and benefited from the wide distribution of checks by the government to individuals (Figure 1). Restaurants and bars experienced a 13.4% gain, indicating vaccine-supported reopenings contributed to the growth. Consumer prices rose 0.6% last month and have risen 2.6% in the last year. Increased gasoline prices contributed to the large monthly gain.

Stock markets continue to rally. The S&P 500 tacked on another 1.4% and is now up 11.9% this year. The MSCI ACWI index added 1.5% last week as international markets showed strength. The Bloomberg BarCap Aggregate Bond Index gained 0.3% despite the tendency for strong economic data to pressure bond prices.

This week new data on existing and new home sales will provide insight into how sales volume and prices are adjusting to the low number of houses available for sale. First quarter earnings reports will also pick up this week.

Figure 1

First Quarter Report Card

The first quarter report card for the U.S. economy keeps looking better and better. First quarter gross domestic product (GDP) is expected to rise more than 5%. At the beginning of the quarter, roughly 2% growth was expected. A combination of economic stimulus, vaccine distribution, and general economic momentum contributed to the impressive economic data.

Retail and food service sales rose 9.8% in March compared to February (Figure 1). The surge in retail activity was created by the flood of checks from the government to individuals. The dark blue bars in Figure 1 show how retail spending has been affected by the virus and stimulus programs. Big surges in January and March were driven by stimulus checks. April’s data will be closely watched to see if there is another negative month, like February, or if spending will remain strong.

The wide distribution of vaccines contributes to the potential for sustained economic growth. Sales at restaurants and bars rose 13.4% last month after only climbing 0.7% in February. While supported by stimulus checks, more people eating out is likely being driven by a steady stream of vaccinations that are helping them to feel safe about venturing out.

Another key to maintaining the growth trend is getting people back to work. Initial jobless claims plummeted 193,000 to 576,000 in the most recent report. It is the first time claims have been that low since mid-March of last year. The improvement means more people returning to work and a steady level of income.

The Consumer Price Index (CPI) showed some signs of spiking higher, but closer examination shows inflation picking up only slightly. Much of the 0.6% in monthly prices and the 2.6% gain over the last year can be attributed to increased gasoline prices. Gasoline prices rose 9.1% over the last month and 22.2% over the last year. Energy and fuel prices are often volatile. Core CPI, which excludes energy, increased only 0.3% and is up just 1.6% over the last year. As we have mentioned in previous updates, inflation dropped sharply in the early months of the pandemic. As those months drop off the 12-month measurements, inflation will temporarily jump upward.

The industrial sector also contributed to the gains. Industrial production rose 1.4% last month. Manufacturers don’t receive the same benefit from checks to individuals as retailers do. The manufacturing recovery may also be delayed by supply chain challenges. The microchip shortage and temporary blockage of the Suez Canal may affect the ability of manufacturers to produce goods as planned. Stronger growth in the industrial sector would be a good indicator of a sustained economic rally.

If the U.S. economy were a student, her report card would bring great cheer. Yet, economic recoveries are never finished. Like an endless school semester, the tests keep coming. The big test for April is whether the great performance in March can be sustained without the stimulus making the test so much easier.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.dol.gov/ui/data.pdf

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.bls.gov/news.release/pdf/cpi.pdf

https://www.federalreserve.gov/releases/g17/current/g17.pdf

Compliance Case # 01010945