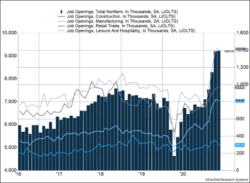

The U.S. economy continued to show signs of a mismatch between demand and supply. Nearly 3 million workers have been unemployed for more than a year; yet, there are 9 million available jobs in the U.S. (Figure 1). Matching those open positions with available workers remains key to a sustained economic recovery.

Key Points for the Week

- Job openings remain above 9 million in the U.S.

- President Joe Biden signed an executive order designed to limit the market power of the largest U.S. companies.

- Chinese consumer inflation rose only 1.1% in the last year, while Chinese producer prices surged 8.8%.

Expectations for future growth are showing mixed signs. Strong demand is pressuring Chinese producer prices, which increased 8.8% over the last year. Chinese consumer prices only increased 1.1%. Inflation risk seems to be ebbing. U.S. bond yields have been edging lower in recent weeks, and investors have become more concerned about future growth and less concerned about inflation.

President Biden signed an executive order designed to introduce more competition into the U.S. economy. The order instructs government agencies to adjust policies targeting merger review, noncompete clauses, and internet policies. This follows efforts by the administration to introduce a global minimum corporate tax rate and should be seen as an effort to reign in corporate power.

Stock investors don’t seem to view it as a serious threat. Large-cap stocks added to recent gains, and early earnings reports were strong. Last week, the S&P 500 gained 0.4%. The MSCI ACWI slid 0.1%. The Bloomberg BarCap Aggregate Bond Index added 0.3%.

This week the U.S. and China report retail sales, and the U.S. will also report key inflation data. In light of recent declines in bond yields, the economic releases may have more impact than normal if either inflation or retail activity significantly outperforms expectations.

Figure 1

The Five Key Events of the Second Quarter

When market information comes to you weekly, or even daily, it can be hard to maintain perspective on the most important items. As Fight Club author Chuck Palahniuk noted, “The trick to forgetting the big picture is to look at everything else close up.” With that in mind, this week’s writeup stretches its time frame out (a little) and addresses five key events in the second quarter.

- Reopening

The U.S. economy is nearly fully open. As larger cities and coastal states continue to open up, the demand for service workers has expanded. Restaurants and hotels are adding staff and, based on the job opening data shared above, wish they could hire even more. Travel data is improving. Movie theaters are reopening. However, many people are still struggling. The first fired are often the last rehired, and 30% of unemployed workers have been out of work for more than one year.

- Delta Variant

The key to maintaining reopening momentum is to limit the number of new COVID-19 cases. The Delta variant is now the dominant strain in the U.S. and seems to be more contagious than the original variant, meaning the unvaccinated may be at greater risk. The vaccines may be slightly less effective against this variant. Increasing vaccination rates globally will be important to the economic recovery as it will allow workers to return to work and fill many of the open positions. A spectator-free Olympics is just one example of lost economic activity because of policies to prevent the spread of COVID-19.

- Global Corporate Minimum Tax

Corporations have been steadily gaining power against governments. In 1970, the corporate tax rate was nearly 50%. In the 90s, it hovered near 35% before dipping to 21% during the Trump administration. Regardless of whether you see this as good or bad, countries have been forced to lower tax rates to be competitive and to dissuade companies from relocating to tax havens. A global corporate minimum tax is an effort to reduce competition between countries and maintain corporate taxes as a revenue source.

- Afghanistan Pullout

The U.S. pullout of Afghanistan ends the U.S.’s longest armed conflict. The move signifies the U.S. being less active in foreign affairs. Since the end of the Cold War, the U.S. has been the world’s dominant power and has provided the military strength needed to keep shipping lanes open and allow for growth in a global economy. The move out of Afghanistan shows the U.S. continues to reassess its willingness to play such an active role and raises questions about the future of globalization.

- China

China has been a big winner during globalization. Yet, its policy approach is changing. Whether using regulation to reign in corporations or being more active globally, China is becoming more aggressive. The country is the largest market for numerous commodities and will soon be the largest consumer market. Risks of economic conflict in Asia are higher as President Xi pursues a more aggressive posture than his predecessors.

One of the societal benefits of markets is they serve to aggregate opinions about significant events, of which there were many last quarter. The S&P 500 jumped 8.5%, so investors weighed these and other factors and thought the mix tilted toward the positive side.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://tradingeconomics.com/united-states/corporate-tax-rate

https://www.psychologytoday.com/us/blog/here-there-and-everywhere/201210/50-quotes-perspective

https://www.google.com/search?gs_ssp

https://www.bls.gov/news.release/jolts.htm

https://www.globaltimes.cn/page/202107/1228250.shtml

https://www.politico.com/news/magazine/2021/07/06/afghanistan-war-malkasian-book-excerpt-497843

https://www.cnbc.com/2021/07/09/delta-covid-strain-dominant-in-ustips-for-vaccinated-people.html

Compliance Case #01079769