Three economic data points released last week indicated the economy continues to rebound despite lingering challenges from the Delta variant. Job openings, which lag other measures by one month, fell to 10.4 million. Declines in demand for leisure and hospitality jobs pulled the openings back from July’s all-time high. Workers are showing increased confidence as a record 4 million people quit their jobs.

Key Points for the Week

- The number of open U.S. jobs pulled back to 10.4 million but remained at very elevated levels. Approximately 4.3 million people quit their jobs in August.

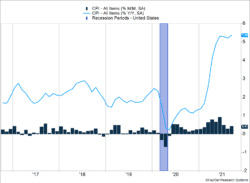

- Consumer prices rose 0.4% as food and energy prices increased. Core inflation, which excludes food and energy, rose 0.2%.

- Retail sales jumped a higher than expected 0.7% last month and are up 13.9% over the last year.

Consumer prices continue to moderate slowly. Core inflation rose 0.2%. Overall inflation rose 0.4% as food prices climbed 0.9% last month and energy prices surged 1.3%. Used car prices, which had been a major contributor to core inflation, dropped 0.7% in August after falling 1.5% in July (Figure 1).

Retail sales jumped 0.7% as a strong job market and healthy personal balance sheets supported additional spending. Purchases at hobby and sports stores contributed to strong gains. Spending at restaurants and bars rose just 0.3%, indicating the Delta variant depressed sales last month.

Markets seemed to like the news. The S&P 500 jumped 1.8%. The global MSCI ACWI surged 2.2%. The inflation data was viewed positively by the bond market. The Bloomberg U.S. Aggregate Bond Index added 0.3%. Third quarter earnings announcements will be a major focus in addition to key Chinese economic data released this week.

Figure 1

Four Reasons Bonds Have a Role in Most Portfolios

Many of the challenges that investors face stem from emotional reactions to changing market conditions. Sometimes these changes are caused by outside events that are difficult to predict. Other times, the seeds that grow into emotional reactions are planted by the investor’s behavior during good times.

The current market environment can certainly be considered good times. The S&P 500 has rocketed 20.4% this year and is up more than 30% over the last 12 months. Those returns alone can entice investors into taking more risk by reducing bonds in favor of other investments with higher potential returns and higher risk. Bonds also have relatively low yields. Because the price of bonds moves inversely with changes in yield, any increase in bond yields would push prices lower.

Nothing in the previous paragraph is wrong, but the analysis misses four key points reviewed below.

- Bonds are most often used to manage risk, and the yield is an extra benefit. Bonds reduce the impact of most downward market moves because they are less volatile than stocks. They are included in portfolios with the primary goal of limiting the effect of a market decline on the portfolio. When investors focus too much on yield and too little on risk, they are sowing the seeds for a potentially bad outcome.

- Intermediate- and long-term bonds offer more protection and higher yield than short-term bonds. Most of the time, long-term bonds offer a higher yield than short-term bonds. When markets drop in anticipation of an economic slowdown, yields often fall and bonds go up in price. The longer-maturity bonds typically see the biggest change in price. These bonds also tend to have a negative correlation — bond prices move in the opposite direction of equity prices — so they may offer more protection and higher yields than short-term debt.

- Bonds still offer protection and pay investors at the same time. Other forms of risk reduction often require the investor to pay for the protection. Bonds pay investors. Over the long run, getting paid while being protected can be a big advantage to long-term portfolio performance.

- Bonds can still provide superior returns to cash if rates move up slowly. Some investors like to point out interest rates have been declining for 40 years and have to go back up. Of course, 10 years ago investors argued the same thing and would only have to change the “40” to “30.” The key point: Just because a market has been doing well doesn’t mean it has to sharply adjust in price. Yields could go lower. Compared to Europe and Japan, U.S. bonds are attractive. Rates also could go up slowly enough for the yield advantage to matter. Yields rose last quarter, but the yield on the Bloomberg U.S. Aggregate Bond Index was sufficient to overcome the yield increase, and bond investors earned a profit.

Each investor’s circumstances are different, and the role bonds play in portfolios may vary. Regardless of the role, focusing on the risk characteristics of bonds rather than yield can help maintain the right risk level for a portfolio and not sow the seeds of future discontent.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.bls.gov/news.release/jolts.nr0.htm

https://www.wsj.com/articles/us-economy-september-2021-retail-sales-11634246791

https://www.bls.gov/news.release/pdf/cpi.pdf

Compliance Case # 01161137