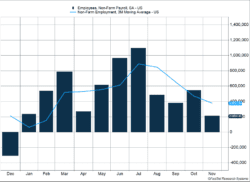

The U.S. employment report continued to send contradictory signals as the fallout from the Omicron variant began to show up in data releases. The jobs report, based on research from a few weeks ago, indicated the U.S. only added 210,000 jobs compared to forecasted gains of 530,000. The household survey showed much stronger gains. Employment rose 1.1 million and unemployment dropped to 4.2%. The household report includes self-employed workers, which the employment report does not. Average hourly earnings grew 0.3% in October and have increased 4.8% in the last year.

Key Points for the Week

- U.S. companies added only 210,000 jobs compared to expectations of 530,000.

- Households indicated job creation remained robust. A trend toward more self-employment and contract work helped reduce unemployment to 4.2%.

- The Federal Reserve signaled inflation risk is higher than expected and suggested it may taper bond purchases more rapidly than expected.

Federal Reserve Chair Jerome Powell announce the Fed may taper its bond purchases faster and raise rates sooner than the market expected.

The spreading Omicron variant and concerns over job growth and inflation pushed stocks lower. The S&P 500 index sagged 1.2 last week. The MSCI ACWI fell 1.2%. The Bloomberg U.S. Aggregate Bond Index rallied 0.5% last week. The November Consumer Price index on Friday will provide the next major look at how quickly prices for goods are increasing.

Figure 1

Consequences

Labor and goods shortages have been key inhibitors to a full economic recovery. As investors get ready for the next inflation update, the consequences of those shortages are starting to bear out on the employment market, monetary policy, and market volatility.

Job creation news was mixed but generally positive. The establishment survey, which includes business reporting, indicated jobs grew by only 210,000 and missed expectations for gains of 530,000. The combined estimated job growth in September and October was increased by 82,000, indicating overall that job growth remains fairly strong.

The household survey, which includes sole proprietors and contract labor, showed job growth was much stronger. Employment rose a staggering 1.1 million, and the number of permanently unemployed shrank by 200,000. The data supports anecdotal evidence that people are starting their own companies.

In addition to the job gains, higher wages have been a major consequence of increased demand. Average hourly earnings have increased 4.8% in the last year. The steady wage gains through most of this year are enticing more people back into the labor force. As the household survey data shows, unemployment dropped to 4.2%, and 600,000 people entered or reentered the labor force.

The shortages have also contributed to higher prices, and a possible consequence is the Fed may move faster than expected. Less than a month after the Fed announced plans to taper its purchasing of $120 billion of high-quality bonds each month, Fed Chair Jerome Powell stated that it’s possible the Fed may consider accelerating the tapering plans to end the program a few months earlier. Fast-tracking the taper would allow the Fed to increase short-term interest rates sooner, which is its primary tool to fight inflation. If the Fed were to end the purchasing program early, the first interest rate hike could come as soon as mid-year 2022. The possible policy change indicates a shift in concern from one part of the Fed’s dual mandate to the other — from unemployment to accelerating inflation.

A supportive Fed has been a key ingredient to the strong market since the COVID-led decline in early 2020. The news the Fed may move more quickly, coupled with the risk from the Omicron variant, had its own consequence on the market: more volatility. Last week the S&P 500 declined by more than 1% for two days and had a total of four moves of more than 1%. The last time the S&P 500 had four 1% daily moves in the same week was May.

Actions have consequences. Investment markets are starting to face the consequences of COVID-19 and the policy responses to fight the pandemic. This week’s Consumer Price Index data will provide further guidance as to how much pressure the Fed faces to act more quickly. After a few quiet months, uncertainty seems to be rising.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.bls.gov/news.release/empsit.nr0.htm

Compliance Case: 01203991